The National Whistleblower Center (NWC) urged the Department of Government Efficiency (DOGE) to strengthen the IRS Whistleblower Program, highlighting its efficiency and cost-effectiveness.

In a letter, NWC leaders detailed how whistleblower-based audits are significantly more productive and accurate than standard audits, with strong support from the current administration, including Treasury Secretary Scott Bessent and President Trump, who encourages whistleblower use via Executive Order 14173.

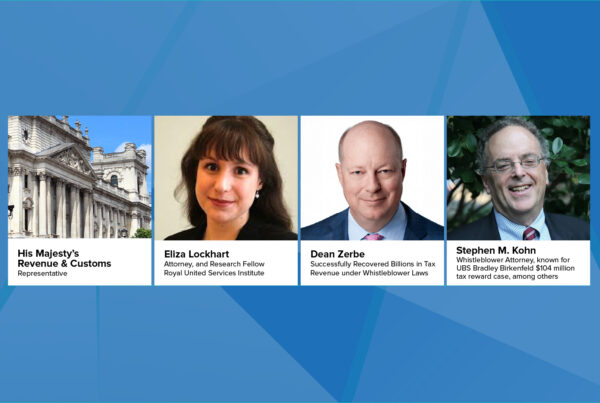

To further enhance the program, an addendum outlined specific reforms, such as improved collaboration with whistleblowers, expanded award scope, removal of restrictive definitions and award caps, and the payment of partial awards. Dean Zerbe advocated for IRS reimbursement of investigative costs in successful whistleblower cases, similar to the False Claims Act, to align government and whistleblower interests and ensure effective case handling.

The NWC emphasizes that maximizing the IRS Whistleblower Program is “commonsense” for efficient tax enforcement.