On October 1st, the law firms of Kohn, Kohn & Colapinto and Zerbe, Miller, Fingeret, Frank & Jadav, working together at the Tax Whistleblower Attorney Group (TWAG), announced that two tax whistleblower awards totaling over $14.3 million were paid to their clients by the Internal Revenue Service (IRS). The awards reflect over $56 million in recouped taxes returned to the Treasury from the whistleblowers’ actions.

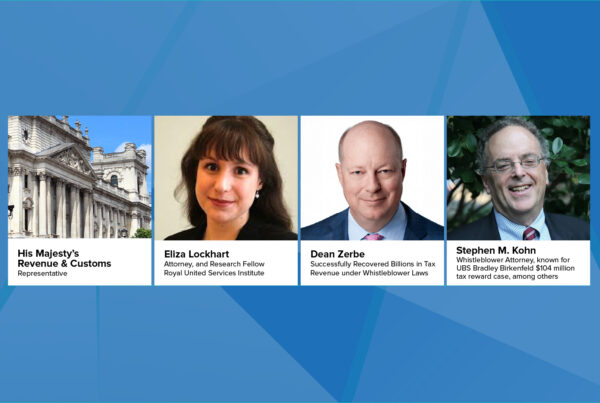

The first of these awards compensated a whistleblower who recovered over $50 million in evaded taxes. Speaking to the case, attorney Stephen M. Kohn of Kohn, Kohn & Colapinto said “I am extremely pleased that we were able to secure this success for our client. […] Thanks to the whistleblower’s efforts, the IRS collected millions of dollars from millionaires seeking to evade tax laws. I join Dean in commending the whistleblower for their dedication and determination in coming forward.” Dean Zerbe of Zerbe, Miller, Fingeret, Frank & Jadav highlighted the role of Mr. John Hinman, Director of the IRS Whistleblower Office (WBO), and his team in securing these awards. “The support the WBO has received from then-IRS Commissioner Charles Retting and current IRS Commissioner Danny Werfel has been instrumental in helping the WBO make strides in putting out the welcome mat for tax whistleblowers,” stated Zerbe. “It is clear that the IRS is welcoming of tax whistleblowers with good information about wealthy individuals and businesses evading tax.”

The second award resulted from a rare whistleblower victory in Tax Court, Whistleblower 18152-17W v. CIR. Historically, whistleblowers have struggled to succeed in Tax Court. Zerbe credited the whistleblower’s courage and lauded the dedication of the IRS WBO and Chief Counsel, stating “thanks to the good faith review of the IRS Chief Counsel and the Whistleblower Office, we were able to realize such a good result for the whistleblowers. […] I commend the whistleblower for his enormous courage – working closely with IRS criminal investigation, including wearing a wire.”

The two award payments signal the IRS’s dedication to tax enforcement and their support of whistleblowers who speak out against related violations. The two awards, made possible by the support of the IRS, work to safeguard financial fairness for all taxpayers by deterring potential violators, as elaborated by Kohn:

“Such wins are good for all tax whistleblowers and the vast majority of honest taxpayers who pay their fair share.” Kohn said. “Further, it is becoming more and more clear that a successful tax whistleblower program not only helps the IRS go after the wealthy tax cheats, but as shown in a recent study in Management Science, a successful tax whistleblower program also deters people from cheating on their taxes in the first place.” Kohn added, citing a 2024 study from Management Science.