February 9, 2026

10:00 AM EST – 3:00 PM GMT

Tax Whistleblower Attorney Group (TWAG) is pleased to announce its participation in an upcoming webinar exploring the United Kingdom’s groundbreaking new tax whistleblower reward program — a historic development that marks the first time the UK has adopted a US-style financial incentive structure for reporting tax fraud.

A Landmark Shift in UK Tax Enforcement

Her Majesty’s Revenue and Customs (HMRC) recently launched its Strengthened Reward Scheme, modeled directly on the highly successful U.S. IRS Whistleblower Program. This policy shift introduces financial rewards of 15% to 30% of collected taxes for individuals who report serious tax avoidance or evasion leading to recoveries of at least £1.5 million. Unlike previous discretionary programs, there is no upper cap on rewards—meaning whistleblowers who help recover substantial sums can receive compensation proportional to the value of their information.

This webinar brings together representatives from HMRC, the Royal United Services Institute (RUSI), and the world’s leading tax whistleblower attorneys to explain how the new program works, who qualifies, and how potential whistleblowers can protect themselves while maximizing their opportunity for a reward.

What You’ll Learn

Attendees will gain critical insights into how to navigate this new program, including how the HMRC scheme differs from the previous discretionary reward system, the reward structure and qualification requirements, examples of tax frauds covered under the program, how to submit a report and what information HMRC requires, the importance of securing a formal written agreement before disclosure, current whistleblower protections under UK law and their limitations, and how the UK program compares to the proven U.S. IRS model.

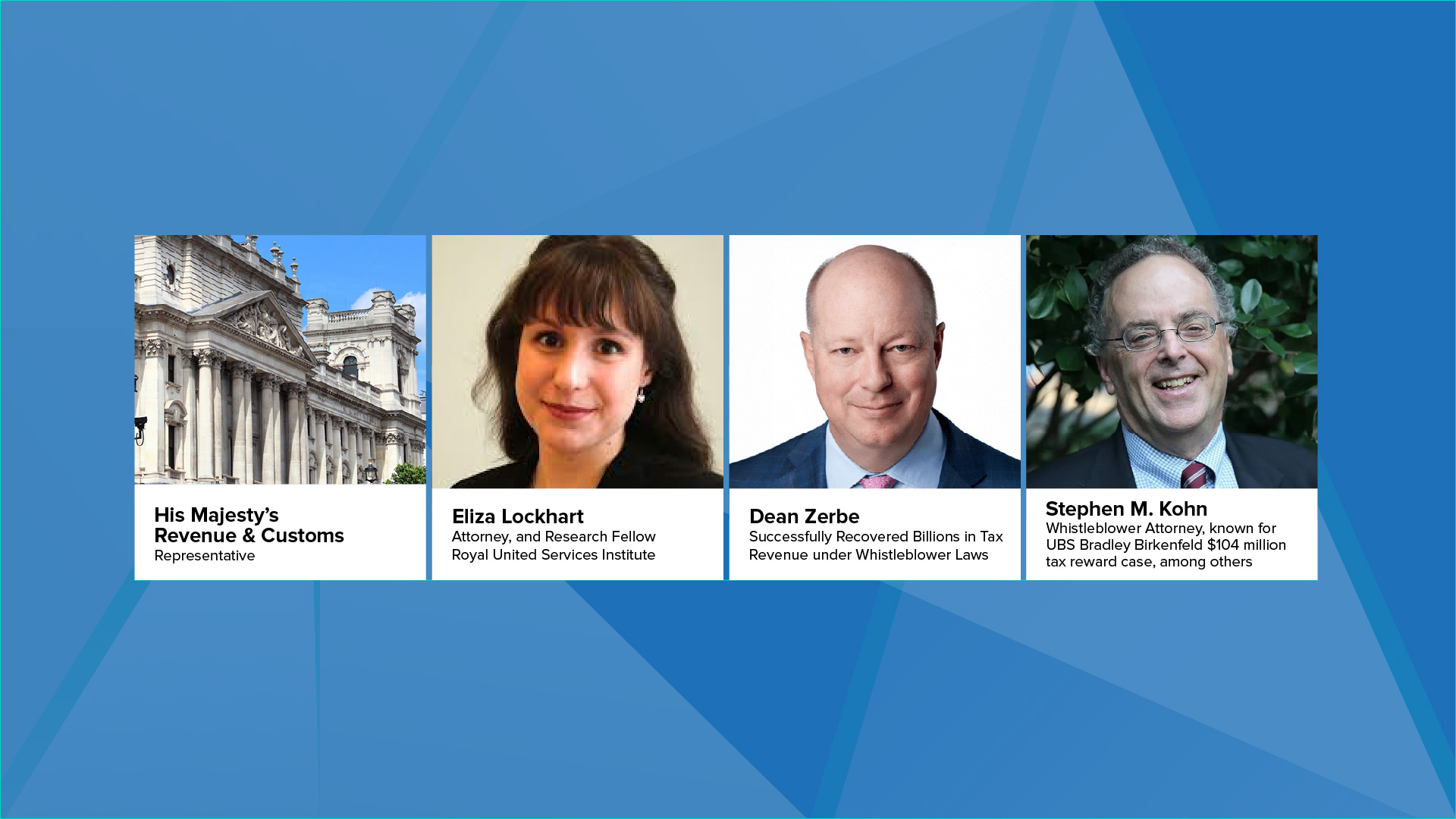

Featured Presenters

HMRC — A representative from HMRC will provide official insight into the new Strengthened Reward Scheme, including submission requirements, qualification criteria, and what whistleblowers can expect from the process.

Eliza Lockhart, RUSI Research Fellow — Author of RUSI’s influential report “The Inside Track: The Role of Financial Rewards for Whistleblowers in the Fight Against Economic Crime,” Lockhart’s research directly informed UK policy discussions and provides critical evidence on why reward programs work.

Dean Zerbe, Tax Whistleblower Attorney — As former Senior Counsel and Tax Counsel for Senator Charles Grassley, Dean Zerbe was the counsel responsible for drafting the modern IRS whistleblower law signed in 2006. He represented Bradley Birkenfeld, the most successful whistleblower in U.S. history, who received a $104 million award for exposing UBS tax fraud.

Stephen M. Kohn, Founding Partner, Kohn, Kohn & Colapinto — A Forbes Top 200 Attorney and Chairman of the National Whistleblower Center, Kohn has successfully represented international whistleblowers in landmark cases including the Danske Bank scandal.

Who Should Attend

This webinar is essential for individuals with knowledge of serious tax evasion considering coming forward, attorneys representing potential whistleblowers or advising on international tax matters, compliance professionals and in-house counsel at multinational corporations, accountants, auditors, and financial advisors, as well as anyone who knows someone who may benefit from understanding this new program.

Event Details

This webinar is sponsored by the National Whistleblower Center and International Whistleblower Advocates.

Date: February 9, 2026

Time: 10:00 AM – 11:00 AM EST / 3:00 PM – 4:00 PM GMT

Format: Online Webinar

Cost: Free

Don’t miss this opportunity to learn directly from the experts shaping this new era of UK tax enforcement. Whether you’re a potential whistleblower, an attorney advising clients, or simply want to understand this significant policy development, this webinar will provide the knowledge you need to take action.