The Internal Revenue Service (“IRS”) Whistleblower Office has released its Annual Report for Fiscal Year 2022, which showed that the Whistleblower Office issued 132 total awards to tax whistleblowers totaling $37.8 million based on $172.7 million in collected proceeds.

According to the report, the average award amount increased by 21.9% this year in comparison to a 14.7% increase in the Fiscal Year 2021. Although the amount and number of awards increased from 2021, many practitioners believe the program is still not reaching its full potential.

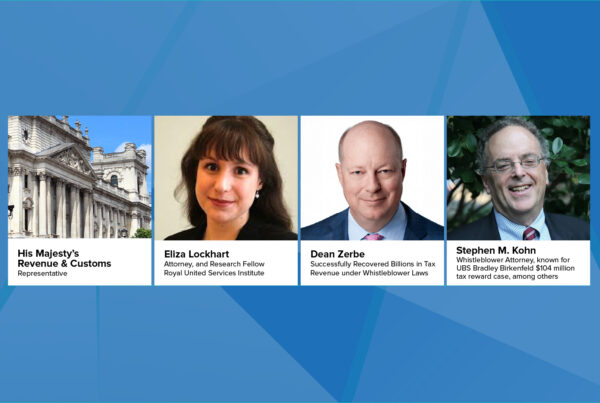

“My hope is that with the commitment to strengthening and improving the program from Treasury and IRS leadership that we can soon see marked improvements – but it is critical that Office of Chief Counsel fully embrace the success of the whistleblower program,” said Dean Zerbe, founding partner at Zerbe, Miller, Fingeret & Jadav LLP.

The report outlined several goals the IRS Whistleblower Office set for the year, including enhancing claim submission, capacity, effectively utilizing high-value whistleblower information, streamlining the distribution of rewards, providing timely updates to whistleblowers on claim status, and strengthening collaboration with program stakeholders.

Despite the figures presented in the IRS Whistleblower Office Report being lower than some expected, IRS Whistleblower Office Director John Hinman remains optimistic about the program and its potential future.

“Going forward, the Whistleblower Office team will continue to make improvements to this important program,” Hinman said. “We will be looking to find ways to raise awareness about the program for potential whistleblowers as well as continue to look for ways to gain internal efficiencies to move cases forward as quickly as possible.”

According to Zerbe, “Particularly good news is that the annual report notes that the whistleblower office now sits on the IRS’s Joint Strategic Emerging Issue Team.”

Regarding awards issued, unfortunately, the number of awards decreased by 47 for this fiscal year compared to last year, where 179 awards were paid as opposed to 132. According to the report, the average years from claim receipt to award payment for Section 7362(b) claims was 11.2 years which showed an increase of 1.3% from the prior year and average claim processing time.

The report also noted the backlog challenges of the IRS Whistleblower Program. The IRS acknowledged further efforts are needed.

The IRS Whistleblower Office also listed some “Issues of Interest,” such as:

- The Whistleblower Office seeks rules related to accessing and disclosing taxpayer Information that Could Provide Stronger Protection for Whistleblowers.

- The Whistleblower Office seeks to require statutory clarification on submitting information and claiming awards.

- The Whistleblower Office seeks to allow information sharing within the government to enhance IRS’s ability to use the information and pay awards.

- The Whistleblower Office seeks to allocate any significant administrative resources to claims involving information and pay awards.

- The Whistleblower Office seeks to significantly increase administrative resources that must be allocated to claims involving information not used by the IRS.

The report highlighted the issues of interest above to help improve the whistleblower program and showcase why certain areas are considered problematic.

“This comprehensive review of the IRS Whistleblower program reflects the value whistleblowing brings to the success of the IRS. By providing tangible information about how whistleblowers programs work, annual reports like this make the bi-partisan support for whistleblowers and strong whistleblower programs irrefutable,” said Siri Nelson, Director of the National Whistleblower Center.

As of now, the IRS has awarded whistleblowers over $1 billion based on the collection of over $6 million retrieved from the voluntary reporting of valuable tax whistleblowers. These figures show just how vital the IRS Whistleblower Program can be. Although the 2022 Annual Report highlighted an increase in the average award amount, practitioners are expecting more dramatic progress in the years to come.