One of the critical elements of the IRS whistleblower law (26 USC 7623) is the provision — (7623(b)(4)) — that allows the whistleblower to go to Tax Court for review of an IRS decision on their case. By providing that whistleblowers can go to Tax Court – Congress ensured that whistleblowers are not at the mercy of the IRS as to receiving an award. There has been in some corners cynicism/uncertainty about whether the Tax Court would provide real protections for whistleblowers – and translating into whistleblowers getting awards. The pudding has arrived with the proof.

Read full article on Forbes.com

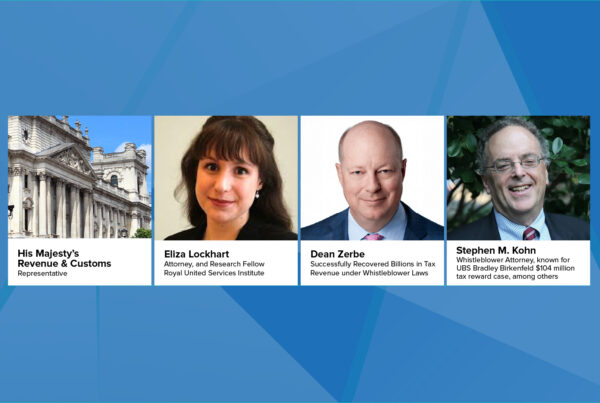

Tax Whistleblowers: Winning in Tax Court